All Categories

Featured

Table of Contents

Will Solicitors Renfrew & Paisley - Will Writing in Dalkeith Western Australia 2022

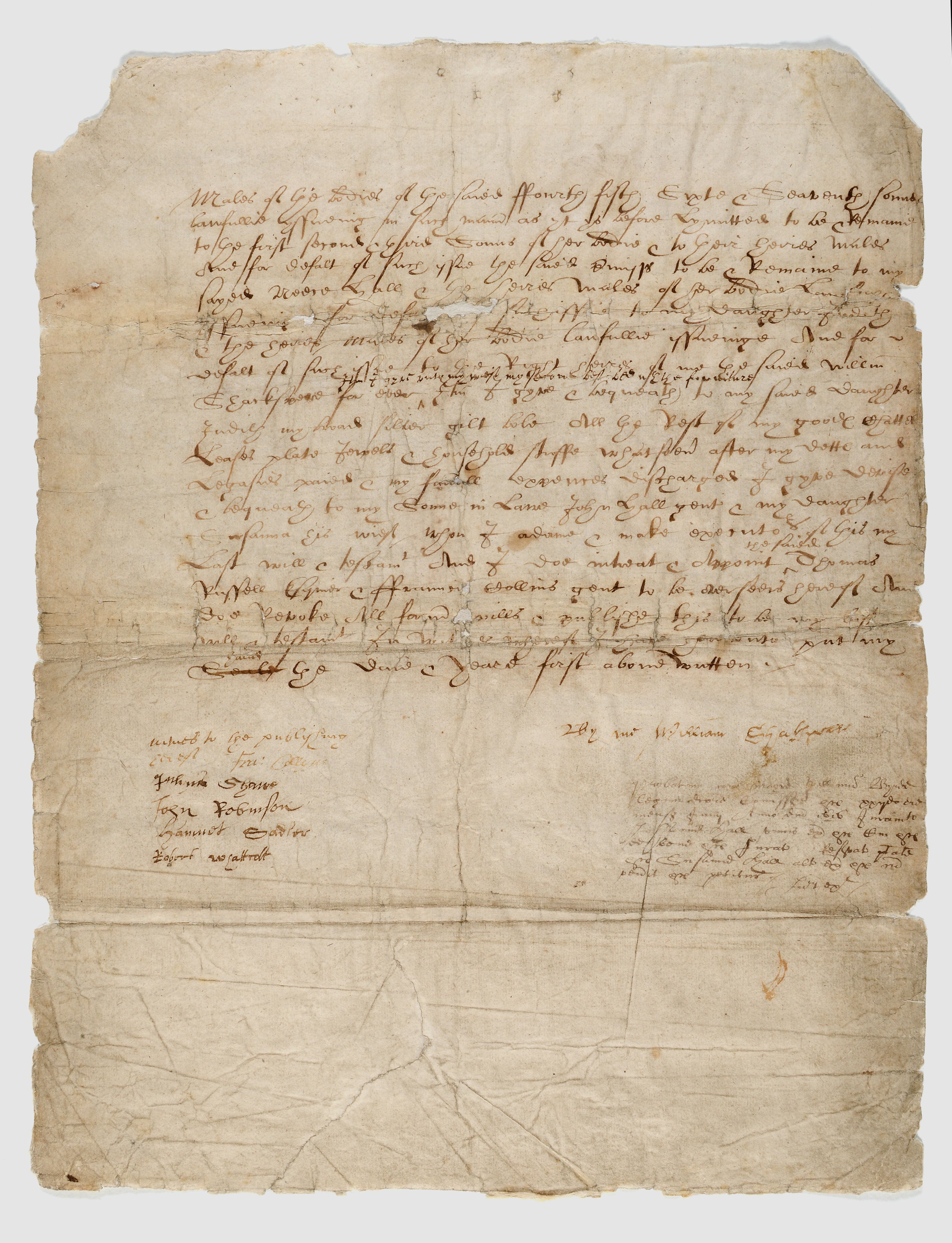

It is necessary for you to make a will whether or not you consider you have lots of belongings or much cash. It is important to make a will because: if you die without a will, there are certain guidelines which determine how the cash, residential or commercial property or possessions ought to be assigned.

If you have actually separated and your ex-partner now lives with somebody else, you may desire to change your will. If you are wed or participate in a signed up civil partnership, this will make any previous will you have made void If you are in any doubt as to whether you must make a will, you ought to consult a solicitor - discover how to get legal advice.

If you wish to make a will yourself, you can do so. It is normally a good idea to utilize a lawyer or to have a solicitor inspect a will you have drawn up to make sure it will have the effect you desire.

Wills & Probate Solicitors in Bertram WA 2022

Arranging out misunderstandings and disputes after your death might result in significant legal costs, which will reduce the amount of money in the estate. You must keep in mind that a lawyer will charge for their services in preparing or inspecting a will. They need to provide you the very best possible info about the expense of their services.

Some typical mistakes in making a will are: not understanding the formal requirements needed to make a will legally validfailing to take account of all the cash and residential or commercial property availablefailing to appraise the possibility that a beneficiary may die prior to the individual making the willchanging the will.

These rules mean that the provisions in the will might be overturned There are some scenarios when it is particularly a good idea to use a solicitor. These are where: you share a residential or commercial property with someone who is not your partner, other half or civil partneryou desire to make provision for a dependant who is not able to care for themselvesthere are numerous family members who might make a claim on the will, for example, a second other half or children from a very first marriageyour long-term house is not in the United Kingdomyou are resident here but there is overseas home involvedthere is a company included If you are a member of a trade union, you might find that the union offers a free choice writing service.

Wills And Probate Lawyer Liverpool - Make A Will Solicitor in Peppermint Grove Western Australia 2020

There are books which supply guidance on how to draw up a will. These can help you choose if you ought to prepare your own will and also help you decide if any of the pre-printed will types offered from stationers and charities are appropriate. It is likewise possible to find help on the internet.

However, will-writing companies are not regulated by the Law Society so there are few safeguards if things go wrong. If you choose to utilize a will-writing company, think about using one that belongs to The Institute of Professional Willwriters which has a code of practice approved by the Trading Standards Institute Customer Codes Approval Scheme (CCAS).

Before making a decision on who to utilize, it's always a good idea to talk to a couple of local solicitors to discover just how much they charge. You may have access to legal guidance through an addition to an insurance coverage policy that covers the expenses of a lawyer preparing or inspecting a will.

The Solicitors Pro Bono Group in Westfield WA 2021

This need to help decrease the costs included. To save time and lower expenses when going to a lawyer, you should provide some believed to the major points which you desire included in your will. You need to consider such things as: how much cash and what home and belongings you have, for instance, property, cost savings, occupational and personal pensions, insurance plan, bank and structure society accounts, shareswho you want to benefit from your will.

These individuals are called beneficiaries. You likewise need to consider whether you wish to leave any money to charitywho should care for any children under 18who is going to figure out the estate and bring out your wishes as set out in the will. These individuals are referred to as the administrators Administrators are the people who will be accountable for performing your wishes and for figuring out the estate.

They will need to pay out the gifts and transfer any residential or commercial property to beneficiaries. It is not needed to appoint more than 1 administrator although it is recommended to do so - for example, in case one of them dies. It is typical to appoint 2, but up to 4 executors can handle responsibility for administering the will after a death.

Latest Posts

7 Qualities Every Good Lawyer Should Have in Ascot WA 2021

Wills & Probate Solicitors in Coogee Australia 2023

Will Changes - How To Amend Your Will in Butler Aus 2021